Taxpayers who cannot file electronically can do so at a SARS branch by appointment. In a statement issued on Thursday SARS said on the day a significant number of taxpayers can expect to receive an SMS indicating that SARS has prepared their tax returns on their behalf and that a draft assessment is available on eFiling or Mobiapp to consider.

It Starts With Auto Submission Sars Filing Your Return For You And Is Only A Provisional Assessment That You Assessment Indirect Tax Financial Statement

Provisional taxpayers who file online electronically - 1 July to 28 January.

Sars efiling 2020 dates. Taxpayers who cannot file online can do so at a SARS branch by appointment only. Phase 1 April 15 to May 31 2020 Employer and third-party filing. Taxpayers who file online.

1 SEPTEMBER 2020 - 16 NOVEMBER 2020 Taxpayers who require assistance may call our contact centre for completing their tax returns with the assistance of an agent. Taxpayers who cannot file electronically can do so at a SARS branch by appointment. From 1 September 2020 - 16 November 2020 if the return does not relate to a provisional taxpayer and is submitted by using the SARS eFiling platform or from 1 September 2020 - 29 January 2021 if the return relates to a provisional taxpayer and is submitted by using the SARS eFiling platform.

1 July to 23 November 2021. Taxpayers who file online. The individual income tax return filing dates are as follows.

Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp. He also announced the new filing dates for the 2020 tax season which covers the period from 1 March 2019 to 28 February 2020. Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp.

Posted 8 May 2020 under TaxTims Blog On Tuesday evening the SARS commissioner Edward Kieswetter held a media briefing to talk about the challenges that SARS is facing due to Covid-19. Taxpayers who cannot file online can do so at a SARS branch by appointment only. Physical distancing will also slow things down.

The assessment will be based on all third party data that Sars has for a. Know what you would need from an individual to complete their tax return. 1 September to 22 October 2020.

1 July to 31. 1 September to 16 November 2020. He further said the closing date for tax payers who wanted to file at a Sars office which will require an appointment is 22 October 2020 while the closing date for e-filing is 16 November 2020.

Taxpayers who file online - 1 July to 23 November 2021. Provisional taxpayers who file online. Learn how to prepare and file an ITR12 tax return for individuals on SARS eFiling.

Taxpayers who file online. Taxpayers who cannot file online can do so at a SARS branch by appointment only. From 1 August to 31 August 2020 Sars will auto-assess a significant number of individual non-provisional taxpayers.

In total SARS collected a gross amount of R1 6478 billion which was offset by refunds of R2919 billion. 1 September 2020 to 31 January 2021. 1 July to 23 November 2021.

22 October 2020. 1 July to 31 January 2022. 1 September 2020to 31.

If you will be visiting a SARS branch in order to file your tax return then you can file from September 1 2020. 1 July to 31 January 2022. Closing date for taxpayers who cannot file electronically can do so at a SARS branch by appointment.

Learn how to prepare an ITR12 tax return for individuals. Individual income tax return filing dates. Taxpayers who file online.

The deadline for filing is October 22 2020. From 1 August to 31 August 2020 Sars will auto-assess a significant number of individual non-provisional taxpayers. 1 September to 22 October 2020.

WHAT YOU WILL LEARN. 1 September to 16 November 2020. 1 April 2020 SARS REVENUE ANNOUNCEMENT SARS has collected an amount of R1 3560 billion in the financial year ending 31 March 2020.

SARS has put in place a three-phased approach. The assessment will be based on all third party data that Sars has for a particular taxpayer including employment information and interest income. Filing of returns commence through any of the SARS eChannels namely the eFiling website MobiAPP.

After attending this webinar you will. For more info click here. Keep in mind that queues at SARS are likely to be longer than usual so go early and go prepared.

Learn how to file a tax return on SARS eFiling. Individual income tax return filing dates. The South African Revenue Service SARS has announced that the 2020 Filing Season will begin on 1 August 2020.

SARS E-Filing 202021. Taxpayers who cannot file electronically can do so at a SARS branch by appointment.

Sars Mobile Efiling Apk Download For Android Latest Version 2 0 19 Air Za Gov Sars Efiling

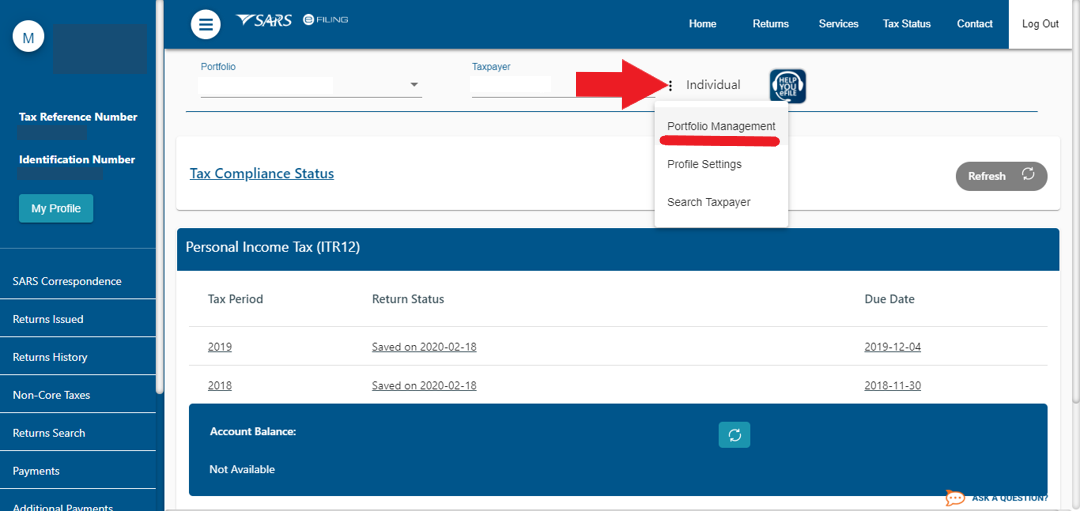

How To Register Your Company For Sars Efiling Taxtim Sa

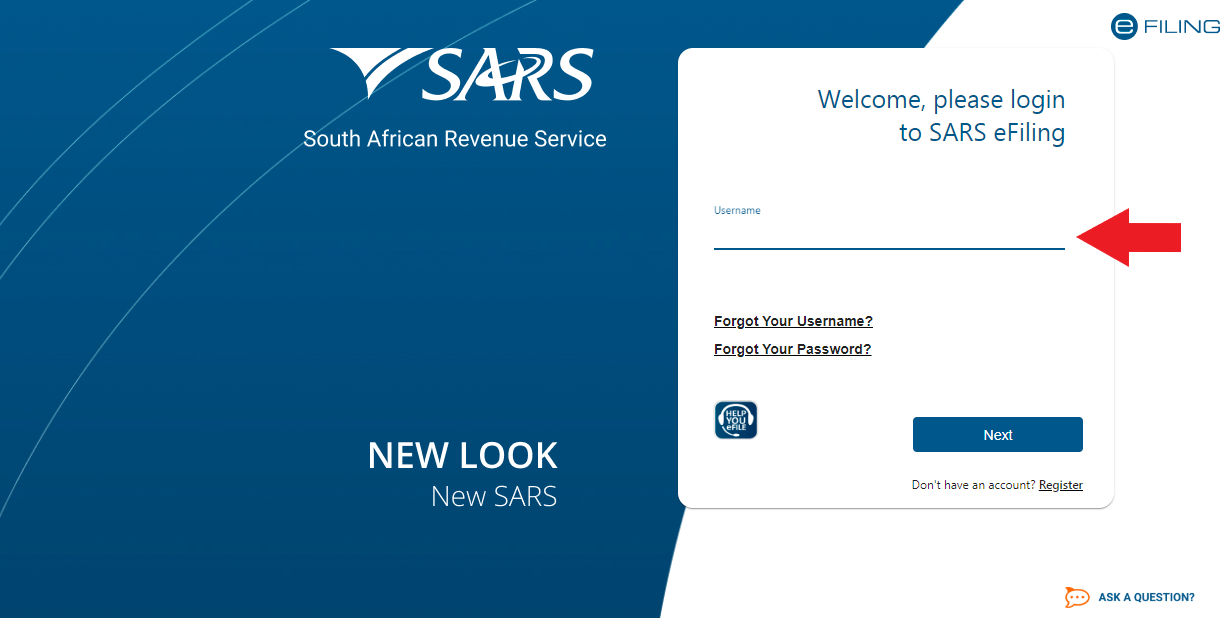

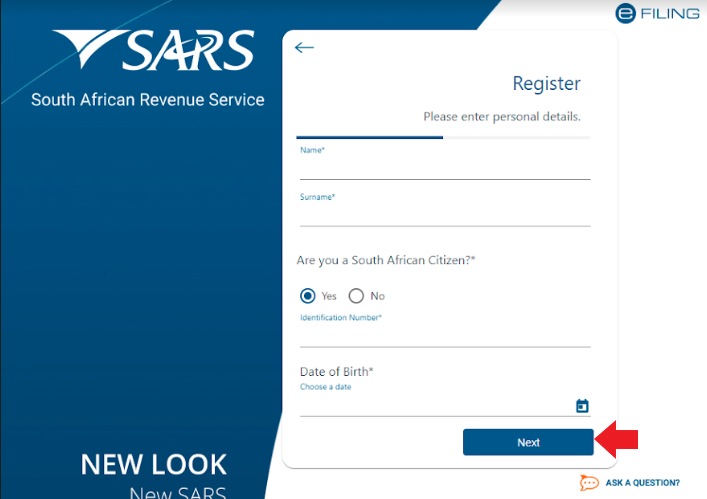

How To Register For Sars Efiling Taxtim Sa

E Filing File Your Malaysia Income Tax Online Imoney Income Tax Returns E Filing In 2020 Online Taxes Income Tax Income

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Efiling How To Register Youtube

Sars Efiling The Ultimate Guide Moneytoday

Tax Season 2020 Will Be Easier Thanks To Sars New Approach Ldp

How To Submit Your 2020 Tax Return Sars Efiling Tutorial Youtube

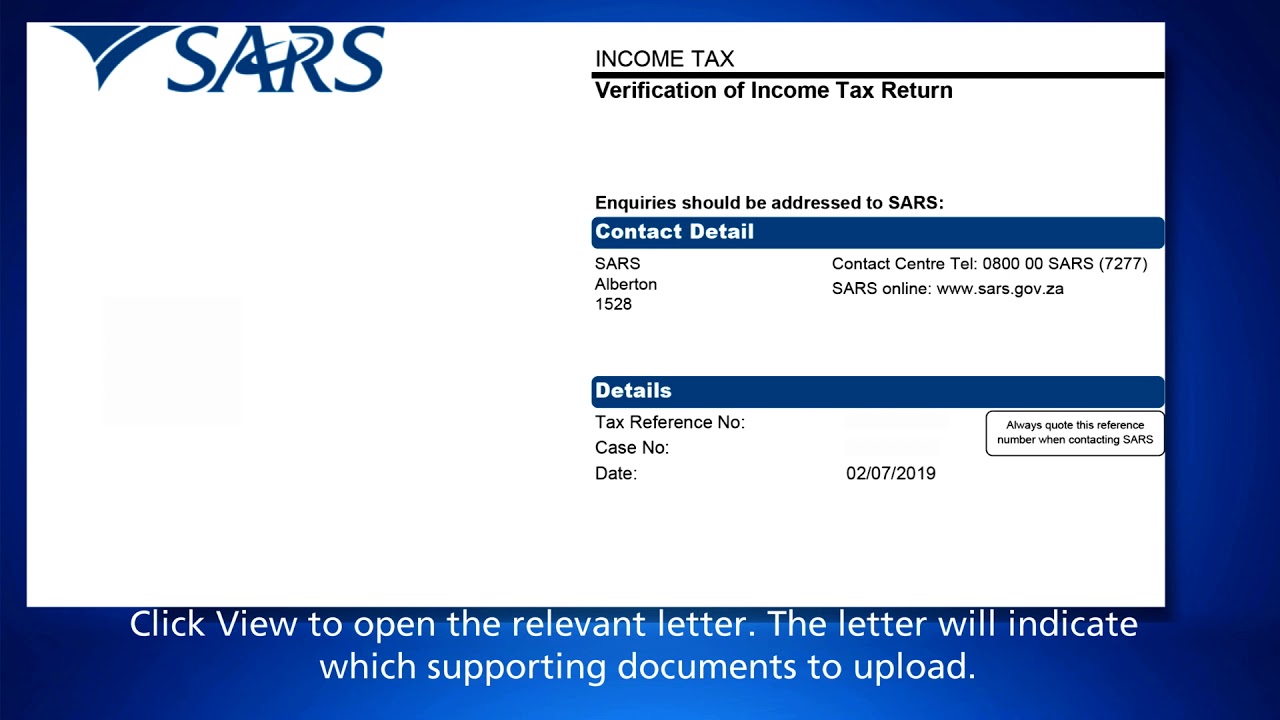

Sars Efiling How To Submit Documents Youtube

Thursday Deadline For Filing Income Tax Returns At Sars Branches

Sars Efiling How To Submit Your Itr12 Youtube

Sars Mobile Efiling For Pc Windows And Mac Free Download

How To Manage Your Profile On Sars Efiling Youtube

Tax Season South African Revenue Service

Pin On Happening Now In South Africa

Efiling System South African Revenue Service